MARCH ISSUE Breakdown of MLS reported sales for these luxury areas analyzed by price points with year supply estimates.

Breakdown of MLS reported sales for 8 luxury areas analyzed by price points with year supply estimates. This detailed information provides important indicators for pricing and marketing strategies for buyers and sellers. Rancho Santa Fe, Del Mar, La Jolla, Carmel Valley, Coronado, Encinitas, Rancho Bernardo/Santaluz/4S Ranch, and Downtown.

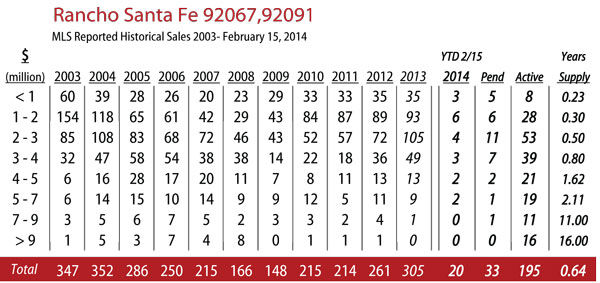

Rancho Santa Fe Luxury Real Estate

Total sales 2/15/2014 = 20 2/15/2013 = 30

Active Listings 2/15/2014 = 195 2/15/2013 = 186

Month(s) Supply 2/15/2014 = 7.5 month 2/15/2013 = 8.5 month

Sales, 10 less than 2013 Inventory UP 5%

Click here for Rancho Santa Fe historical sales compared by price range 2003- 2013 < $1 million, $1 – $3 million, $3 – $5 million, > $5 million

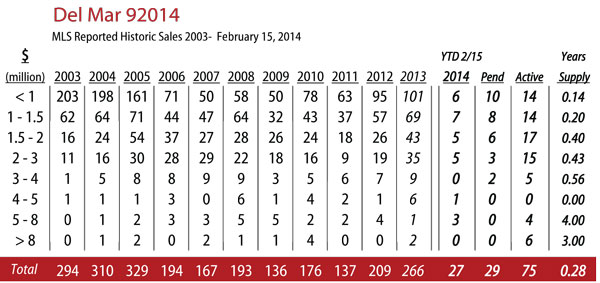

Del Mar Luxury Real Estate

Total sales 2/15/2014 = 27 2/15/2013 = 21

Active Listings 2/15/2014 = 75 2/15/2013 = 72

Month(s) Supply 2/15/2014 = 3.5 month 2/15/2013 = 4 month

Sales UP 29% Inventory Essentially Even

Click here for Del Mar historical sales compared by price range 2003- 2013 < $1 million, $1 – $2 million, > $2 million

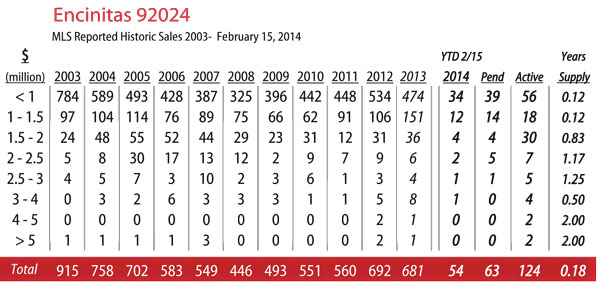

Encinitas Luxury Real Estate

Total sales 2/15/2014 = 54 2/15/2013 = 55

Active Listings 2/15/2014 = 124 2/15/2013 = 105

Month(s) Supply 2/15/2014 = 2 month 2/15/2013 = Just under 2 month

Sales Essentially Even Inventory UP 18%

Click here for Encinitas historical sales compared by price range 2003-2013 < $1 million, $1 – $2 million, > $2 million

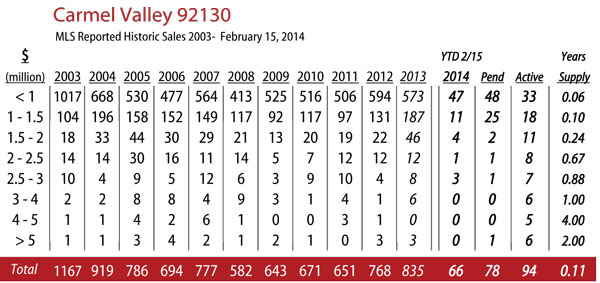

Carmel Valley Luxury Real Estate

Total sales 2/15/2014 = 66 2/15/2013 = 76

Active Listings 2/15/2014 = 94 2/15/2013 = 59

Month(s) Supply 2/15/2014 = 1 month 2/15/2013 = 1 month

Sales 10 Less than 2013 Inventory UP 59%

Click here for Carmel Valley historical sales compared by price range < $1 million, $1 – $2 million, > $2 million

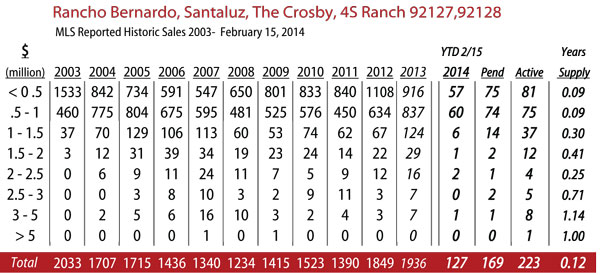

Rancho Bernardo Luxury Real Estate

Total sales 2/15/2014 = 127 2/15/2013 = 137

Active Listings 2/15/2014 = 223 2/15/2013 = 102

Month(s) Supply 2/15/2014 = 1.5 month 2/15/2013 = Less than 1 month

Sales 10 Less than 2013 Inventory UP 119%

Click here for RB historical sales compared by price range < $0.5 million, $0.5 – $1 million, > $1 million

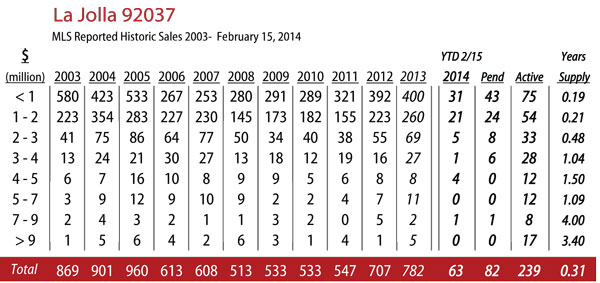

La Jolla Luxury Real Estate

Total sales 2/15/2014 = 63 2/15/2013 = 59

Active Listings 2/15/2014 = 239 2/15/2013 = 233

Month(s) Supply 2/15/2014 = 3.5 month 2/15/2013 = 4 month

Sales, UP 7% Inventory Essentially Even

Click here for La Jolla historical sales compared by price range < $1 million, $1 – $3 million, > $3 million

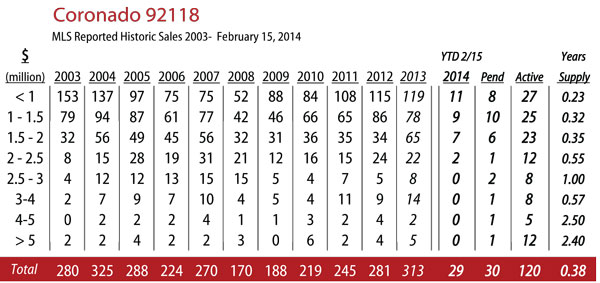

Coronado Luxury Real Estate

Total sales 2/15/2014 = 29 2/15/2013 = 17

Active Listings 2/15/2014 = 120 2/15/2013 = 152

Month(s) Supply 2/15/2014 = 4.5 month 2/15/2013 = 6.5 month

Sales, UP 71% Inventory down 27%

Click here for Coronado historical sales compared by price range < $1 million, $1 – $2 million, > $2 million

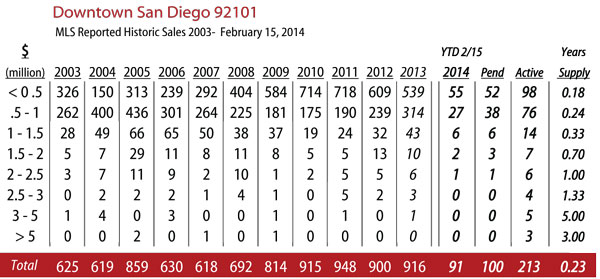

Downtown Luxury Real Estate

Total sales 2/15/2014 = 61 1/15/2014 = 63

Active Listings 2/15/2014 = 213 1/15/2014 = 196

Month(s) Supply 2/15/2014 = 2.5 month 1/15/2014 = 2.5 month

Sales: Essentially Even Inventory UP 9%

Click here for Downtown historical sales compared by price range < $0.5 million, $0.5 – $1 million, > $1 million

*Based on MLS data from these zip codes, 92067,92091,92014,92037,92130,92118, 92024,92127,92128 for the period of 1/01/2013– 2/15/2014. **DataQuick Information deemed reliable but not guaranteed.